About the UCLA Affordability Initiative

The UCLA Affordability Initiative is a campuswide effort to:

- Raise awareness ― among students, families and potential donors ― of the challenge posed by the total cost of higher education.

- Secure philanthropic gifts that make a UCLA undergraduate degree more affordable by increasing scholarship support to eliminate the burden of student loans.

As a public institution serving the people of California, UCLA is aligned with the University of California commitment to provide pathways to debt-free education by 2030 and ensure a high-quality undergraduate education remains financially feasible for students, especially those from our state.

UCLA announced the initiative in April 2023 in tandem with its lead gift, a commitment of $15 million for undergraduate scholarships for California students made by UCLA alumnus Peter Merlone.

Addressing the Total Cost of Education

The national conversation about the rising cost of college tends to focus narrowly on the price of tuition. This overlooks the total cost of education ― the sum of tuition plus the cost of housing, food, books, supplies, health insurance, transportation and personal expenses ― which presents the true challenge for today’s students and families (See the slideshow: Total Cost of Education, 2022–23).

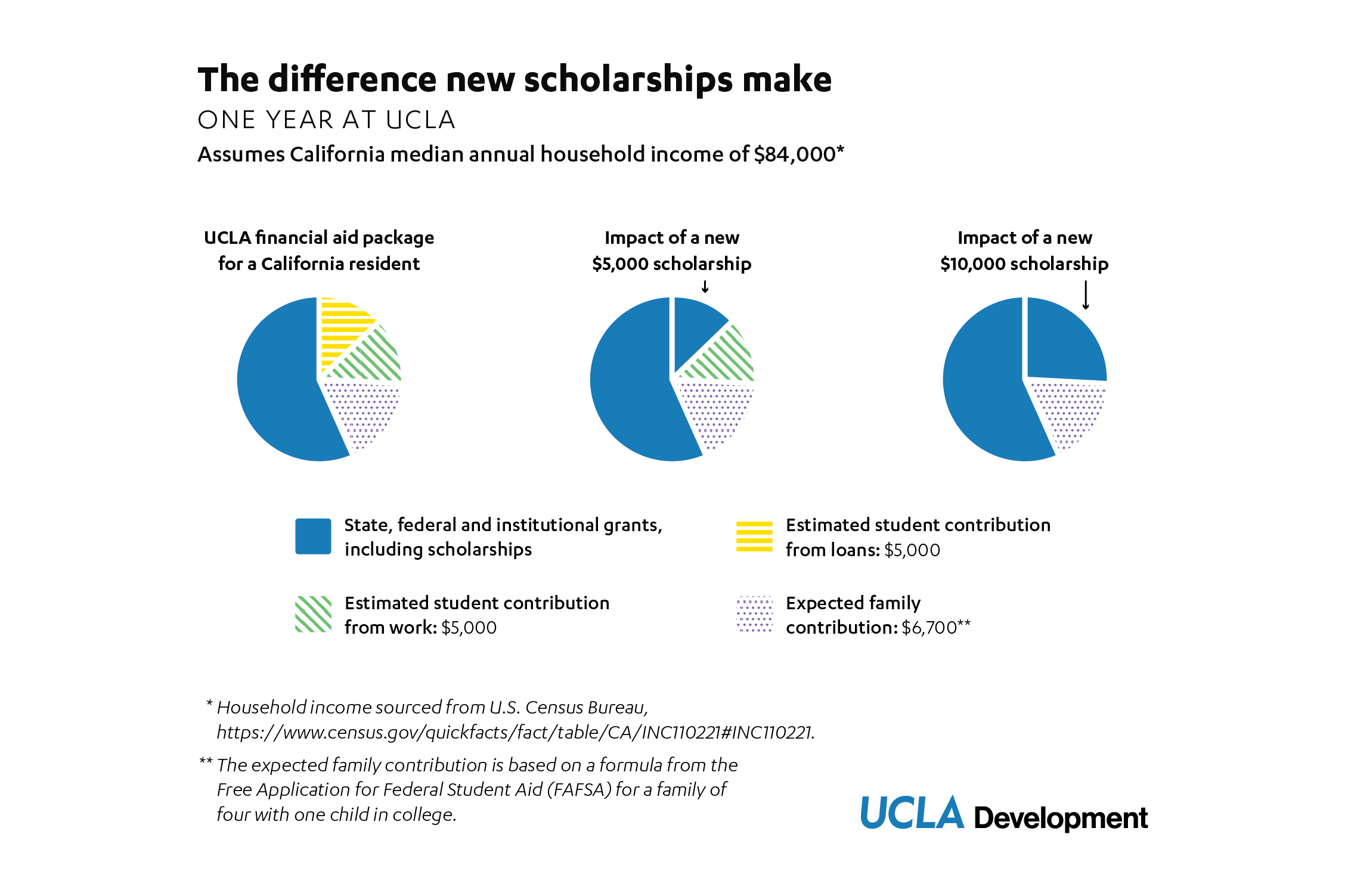

For students who receive financial aid, financing a college education can include student contributions from loans and work, family contributions, and grants and scholarships (See the slideshow: Covering the Total Cost of Education, 2022–23).

Striving for Equity

There is a concern for equity to consider when evaluating the effectiveness of student loans as a college financing strategy. Student loans postpone some of the financial burden of obtaining a degree. However, students who graduate with loans often decide to postpone or entirely forgo graduate education. They also make career choices defined by the need to repay their debt.

Additionally, young women and people of color are the groups most likely to take on student loan debt and to carry higher amounts of debt; due to wage disparities, they also pay down their debt more slowly. Student debt has even been shown to play a role in the ability of people of color to achieve home ownership.

For these reasons, the initial financial goal of the UCLA Affordability Initiative is to leverage donor-funded scholarships to limit, and in some cases eliminate, student loan borrowing. For most students, that would require an additional scholarship of $5,000 annually.

New scholarships of $10,000 annually would have an even greater impact on the student experience. This level of additional funding would enable most students to forgo paid work during the academic year and summer breaks. Instead, they could devote more time to their courses and extracurricular activities, and make the most of career-building opportunities, participating in research and unpaid internships (See the slideshow: The Difference New Scholarships Make).

A Growing Need

Volatility in the U.S. and global economies, the high cost of housing in Southern California, ongoing impacts of the COVID-19 pandemic and other factors are creating a college affordability challenge for students and their families.

UCLA donors are expressing increased concern about the economic headwinds facing California students ― and what they mean for California’s future.

UCLA graduates go on to become our innovators, leaders and change-makers of tomorrow, improving life for everyone. It is in the best interest of California and its people for UCLA to provide scholarships to help pay for the entire cost of higher education so that we can retain promising people by educating them here at home.

You Are Invited to Be a Part of the College Affordability Solution

Throughout UCLA’s history, generous donors have come forward to support students. UCLA seeks all those who are dedicated to California and Californians and wish to support a brighter future through philanthropic giving. All donors can make a meaningful impact, either through gifts in support of current-use scholarships or by establishing endowed scholarship funds, which will ensure continued funding for this critical initiative.

To begin a conversation about creating a new scholarship under the banner of the UCLA Affordability Initiative, contact Executive Director of Development for Scholarships & Student Support Initiatives Brittany Schoof at (310) 612-2085.

The real cost of higher education goes well beyond tuition – there are many other expenses that students and families need to consider.

Students who receive financial aid cover their college costs by drawing on a variety of funding sources. They meet their expected contribution by working during the academic year and summer breaks, and with educational loans.

Scholarships help students focus on making the most of college, not how they’re paying for it now or in the future. A new annual $5,000 scholarship could minimize or even eliminate a student’s loans. A new annual $10,000 scholarship could reduce a student’s dependence on loans and paid work to finance a college degree.